2020 has been an unpredictable year; with the pandemic every business was a loss. However, it also makes us think something out of the box. Due to the COVID-19 outbreak, the finance sector has been affected. Some companies are counting losses and proposing cost-saving measures. Others are rethinking their offerings in a bid to adapt them to changing customer needs. It empowers different startups and encourages them to compete with the banks and leading financial institutes.

As per the recent fintech app industry survey published by Finch Capital; loans, lending platforms, mortgages, and life insurance services are the undoubted winners both among fintech startups and established financial market players.

Despite whether you are an established financial company planning a digital shift, a newbie in the market, or an app developer, here are remarkable fintech startup app ideas to consider in 2021.

1. Loan Lending Apps

Lending apps are apps that build a bridge between those who want loans and loan lenders. Due to the COVID-19 lockdown, the economy goes down and many organizations and individuals were looking for quick loans to fulfill their needs. Compel by Artificial Intelligence and big data analytics, lending apps means the loan assignment process by analyzing customer data, performance patterns, credit history, and shopping activity to indicate if a customer qualifies for a loan. MoneyLion is one of the best examples of a lending and savings fintech app. The app also helps users maintain their finances, has exceptional testimonials, and a steadily growing user base.

2. Regtech Apps- A Different Idea

RegTech app helps financial companies to automate processes like collecting reports, verifying client identity, monitoring new regulations, submitting reports. Identifying risk, translating requirements into concrete steps that companies have to take to avoid penalties, and reporting multiple transactions, and others.

For example, Cappitech is an Israeli fintech startup that automates the making and assent of regulatory reports. Regtech apps also help firms to keep an eye on their data security.

3. Smartphone banking apps

It may sound not like a unique app, but today, customers intercommunicate with digital banking to urge quick and problem-free access to banking services. High market demand has set the platform for the emergence of digital-only banks, like Ally Bank, and therefore they have to maintain social distancing has made them the most effective option during the crisis. Traditional banks like Bank of America and others have also built mobile banking apps and are competing with newcomers.

Typically, a fintech banking app allows users digital access to services like opening and closing accounts, deposits, making online transactions, managing credit cards, etc. It also integrates AI chatbots for quick consultation and financial advice.

4. Peer-2-Peer Fee Apps

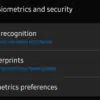

Peer to Peer market has seen enormous growth in the last few years. The applications that offer P2P services provide consumers the convenience of transferring funds from one account to another spontaneously. In other words, users can transfer money quickly and directly to any other bank account. These applications are becoming popular as they are reducing the need for mediators or third-party websites that charge an additional commission fee to help fund transfers. These applications are created using advanced technology such as biometric, facial recognition, Near-field communication (NFC), and more to assure smooth and modernized transactions. You should think of creating this app if you wanted to earn big.

5. Insurtech Apps

Insurtech apps are insurance fintech apps that are powered by business intelligence, data science, IoT, and mobility solutions. These apps collected the data and analyze them to give customers personalized offers, pricing, and recommendations.

Allowing real-time data to the insurers, the apps help them to manage risks effectively and increase the Return on Investment (ROI). With the help of fintech app development, insurance companies can develop their business process and experience of clients.

Insurtech mobile apps are available to the customers at any time and at any place. As it is not possible for the agents to be available 24/7*365 to help the customers but apps can.

6. Fintech Equity Apps

We all have heard about Equity funds and how people are interested to invest in them. Similarly, there should be Equity apps. Equity financing becomes easy with fintech apps as it encourages you to make money faster. Such apps are formed by companies that try difficult to connect the investors with the people who need funding to build their business.

With the equity apps, without any paperwork, the fundraising process can be done online. Thus, it becomes very clear for investors to invest in funds.

7.Fintech- Cryptocurrency Apps

Crypton was one of the most used words in 2019. Finally, think about employing the benefits of blockchain to create an app for cryptocurrency trading. Cryptocurrencies are digital assets collected during a shared entry. An example of such apps is Coinbase, the world’s top app for trading currencies like Bitcoin, Ethereum, and Litecoin with a built-in wallet for digital money. except cryptocurrency trading, samples of using blockchain in fintech include money transfer, money lending, insurance claims processing, asset management, etc.

The security and also secured information sincerity of blockchain apps can become a vital advantage.

8. Crowdfunding Apps

People may have an idea but no finance as much as needed than what they should. Crowdfunding apps help budding entrepreneurs raise money for their initiatives. They also provide them with priceless proof-of-concept capabilities: by posting their startup idea on a crowdfunding platform, they will quickly see if investors have an interest.

There are preferred corners, however, that have their assigned apps for crowdfunding purposes. For instance, Patreon helps creative professionals crowdfund their content, while causes target non-profit campaigns and endeavors.

9. Personal Financal Apps

For most of the utmost people out there, maintaining personal finance, savings, and investments, remains a challenge. No one is born financially literate, and financial advisory services remain a number of the highest fintech startup app ideas. Today, Robo-advisers offering support on investments, retirement, and savings are slowly shifting mainstream.

Apps like Mint bring clients a holographic picture of their finances, including loans, investments, and MasterCard accounts.

10. Investment and Trading Apps

Apps for stocks and assets trading are a number of the most popular fintech app trends in today’s financial scene. Trading and investment apps use a blend of blockchain, AI, and Machine Learning to thoroughly develop trading results. Algorithmic trading reduces human error and emotional circumstances make smart decisions approved data, instantly reacts to the changing market situation, and enables traders to trade from multiple accounts all without delay.

AI and data analytics help customers to get quick insights about possible investments and make informed judgments.

One of the trading apps quickly taking over the US market is Robinhood. This app for investment and stock trading is predicted to cost over $7.5 billion.